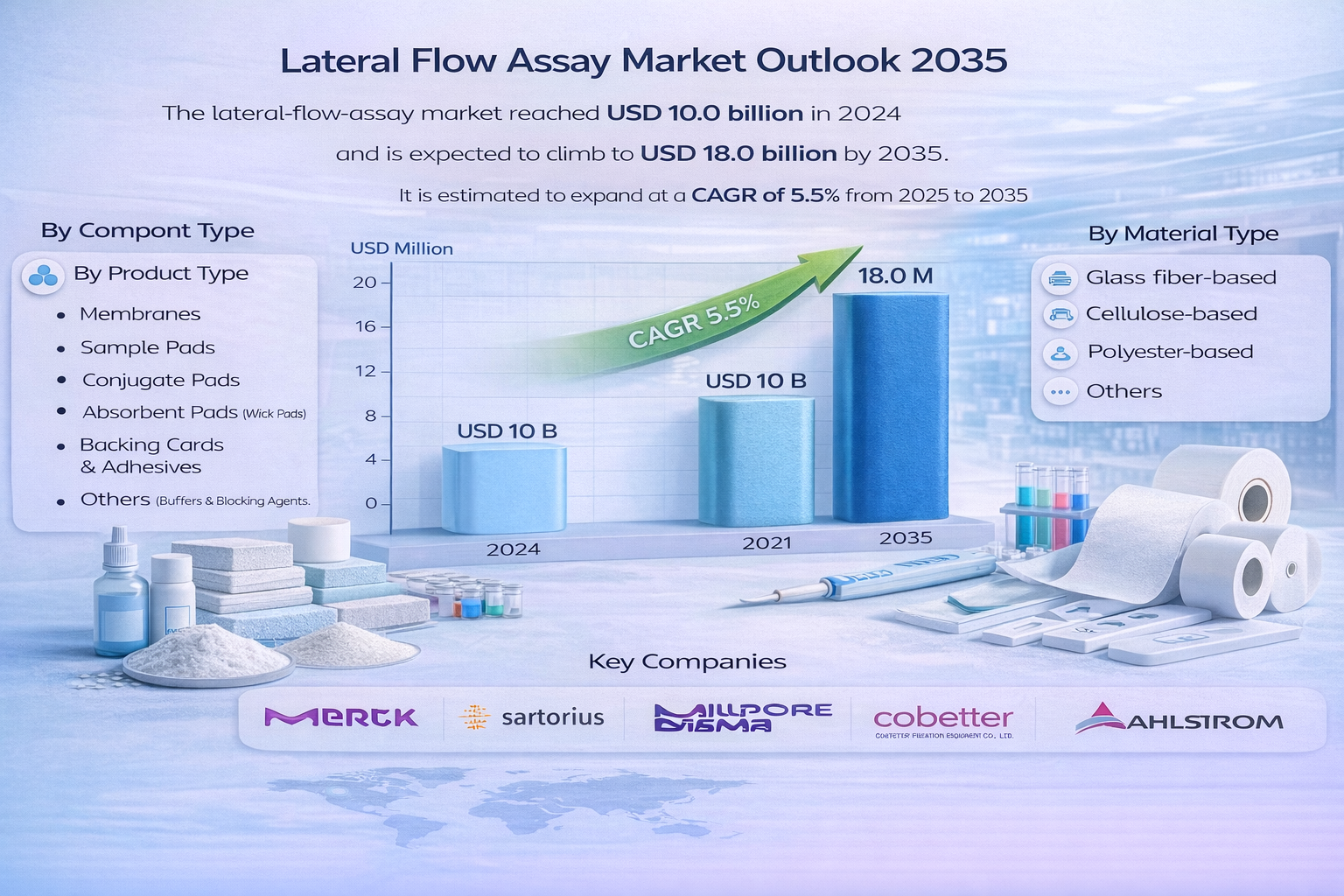

Global Lateral-Flow-Assay Industry Set to Grow at 5.5% CAGR Through 2035

The global lateral-flow-assay market was valued at USD 10.0 billion in 2024 and is projected to witness steady growth over the forecast period. Supported by increasing demand for rapid diagnostics across healthcare, pharmaceuticals, and point-of-care testing, the market is expected to reach USD 18.0 billion by 2035. This growth trajectory represents a compound annual growth rate (CAGR) of 5.5% from 2025 to 2035, driven by technological advancements, expanding disease screening programs, and rising emphasis on early and accurate diagnosis.

The global market for lateral-flow-assay (LFA) is a response to the increasing demand for point-of-care diagnostics, materials innovation, and decentralized delivery of healthcare. LFA components - mainly membranes, sample/conjugate/absorbent pads, labels, backing cards, and reagents - are the main determinants of the sensitivity, reproducibility, and cost of LFAs as a product. Therefore, the quality and reliability of component supply, specifically led by the diagnostic original-equipment manufacturers (OEMs) and contract-development manufacturers (CDMOs), will guide purchasers' decisions.

Your Data Journey Begins Here: Request Your In-Depth Sample! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=39356

The increased use case applications beyond infectious disease, as well as the basic biology of cardiac marker, fertility tests, drug residue screening and some oncology biomarkers, are increasing addressable markets and cross-industry adoption. Furthermore, funding from public and private sector partners for epidemic preparedness and procurement structures favouring rapid technologies common in procurement are creating recurring demand streams.

Market Segmentation

By Product & Service Type

- Kits and Reagents: Dominates the market (approx. 66% share) due to high repeat-purchase rates for infectious disease and pregnancy testing.

- Lateral Flow Readers: The fastest-growing sub-segment, including digital, handheld, and benchtop readers that provide quantitative data rather than simple "yes/no" lines.

By Technique

- Sandwich Assays: The most common technique, used for larger analytes like pathogens and proteins.

- Competitive Assays: Primarily used for small molecules, such as drug-of-abuse testing and some steroid hormones.

- Multiplex Detection Assays: An emerging segment allowing for the simultaneous detection of multiple targets (e.g., distinguishing between Flu A, Flu B, and COVID-19 in one strip).

By Application

- Clinical Testing: The largest segment, covering infectious diseases (HIV, Malaria, Hepatitis), cardiac markers (Troponin), and pregnancy/fertility.

- Veterinary Diagnostics: Growing demand for rapid testing in companion animals and livestock.

- Food Safety & Environmental Testing: Used to detect allergens, toxins, and water contaminants.

By Industry Vertical (End-User)

- Hospitals & Clinics: Primary users for emergency triage and immediate patient care.

- Home Care Settings: Rapidly expanding due to the rise of "Self-Care" and telehealth.

- Diagnostic Laboratories: Used for rapid screening before confirmatory tests.

- Pharmaceutical & Biotech: Utilized in drug development and quality control.

Regional Analysis

- North America: Currently the largest market (approx. 35%–41% share). Growth is sustained by advanced healthcare infrastructure, high healthcare spending, and a clear regulatory pathway for OTC (Over-the-Counter) tests in the United States.

- Europe: Holds the second-largest share, with a strong focus on decentralized testing in countries like Germany and the UK to reduce the burden on national health systems.

- Asia-Pacific: Anticipated to be the fastest-growing region. Driving factors include a massive population base, rising disposable income, and government initiatives in China and India to improve rural healthcare access.

Market Dynamics

Drivers

- Rising Prevalence of Infectious Diseases: Emerging threats (e.g., Avian Flu H5N1, Mpox) continue to underscore the need for rapid screening.

- Decentralization of Healthcare: A global shift toward treating patients at home or in community pharmacies rather than centralized hospitals.

- Aging Population: An increase in chronic conditions requires frequent monitoring of biomarkers like cholesterol and glucose.

Challenges

- Sensitivity & Accuracy: LFAs are sometimes perceived as less accurate than lab-based PCR tests, leading to "false negatives" in low viral load cases.

- Regulatory Hurdles: Stringent FDA and CE Mark requirements can delay the launch of innovative multiplex or digital assays.

- Reimbursement Issues: Inconsistent insurance coverage for rapid tests in certain regions limits widespread professional adoption.

Market Trends

- Digital Integration: The use of smartphone apps as "readers" to interpret lines and automatically upload results to electronic health records (EHR).

- Next-Gen Materials: The shift from traditional colloidal gold to fluorescent labels and quantum dots to improve sensitivity.

- Sustainability: Development of biodegradable housings and paper-based components to reduce the plastic waste associated with single-use tests.

Competitive Landscape

The market is highly competitive, featuring a mix of medical device giants and specialized diagnostic firms. Key players include:

- Abbott Laboratories (Leader in POC and rapid diagnostics)

- QuidelOrtho (Strong presence in respiratory and cardiac testing)

- Becton, Dickinson and Company (BD)

- Merck KGaA (Major supplier of LFA components and membranes)

- Danaher Corporation (Cepheid)

- Bio-Rad Laboratories

Recent Developments

- In January 2025, BIOMÉRIEUX announced an agreement to acquire SpinChip Diagnostics ASA, a Norwegian diagnostics company known for its innovative immunoassay platform. This acquisition aims to bolster bioMérieux's point-of-care diagnostics capabilities.

- In February 2024, BIOMÉRIEUX entered into a strategic research collaboration with the U.S. Food and Drug Administration (FDA) to develop advanced tools for detecting food-borne pathogens, including Shiga-toxin producing E. coli, Cyclospora cayetanensis, Salmonella spp., and Listeria monocytogenes.

Future Outlook (2035)

By 2035, the lateral flow assay will likely no longer be seen as just a "screening" tool but as a primary diagnostic platform. The integration of Artificial Intelligence (AI) for image interpretation and the expansion into Oncology Biomarkers (early cancer detection via liquid biopsy) will significantly expand the total addressable market.

Key Study Point: The "Multiplexing" trend is the single most important technical shift, as it allows a single test to provide a comprehensive diagnostic profile, making LFAs indispensable in resource-limited settings.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com