Copper and Silver Components in PowerandIndustrial Performance: Key Metrics and Growth Analysis 2032

The Copper and Silver Components in Power and Industrial Market is witnessing steady expansion as global industries intensify investments in electrification, renewable energy integration, and advanced industrial automation. Valued at US$ 9,789 Billion in 2024, the market is projected to grow at a CAGR of 8.6% from 2025 to 2032. The increasing demand for efficient electrical conductivity, thermal stability, and durable contact materials in power distribution systems and heavy industrial applications is significantly contributing to market growth.

Copper and silver are critical materials in power transmission and industrial equipment due to their superior electrical and thermal conductivity. Their integration into switchgear, circuit breakers, relays, connectors, and busbars ensures reliability and operational safety across energy infrastructure and manufacturing environments.

Market Growth Drivers

The global push toward renewable energy and grid modernization is one of the primary drivers of this market. As countries invest in solar, wind, and smart grid technologies, the demand for high-performance conductive materials increases. Copper remains the backbone of power transmission and distribution networks, while silver-based alloys are widely used in electrical contacts to enhance performance and minimize wear.

Industrial automation and expansion of electric vehicle (EV) charging infrastructure also play a crucial role in boosting demand. Modern industrial machinery requires durable components capable of handling high current loads and temperature fluctuations. Silver and copper composites provide the necessary resilience and efficiency required in these demanding applications.

Additionally, rapid urbanization and industrialization in emerging economies continue to strengthen demand for power infrastructure, further supporting market growth.

Material Segment Insights

Based on material type, the market includes Silver Tungsten Carbide Graphite, Silver Molybdenum, Braze Alloy, Silver Nickel, and Silver Cadmium Oxide.

Silver Tungsten Carbide Graphite is widely utilized in high-voltage applications due to its excellent arc resistance and mechanical strength. Silver Molybdenum offers improved thermal conductivity and wear resistance, making it suitable for heavy-duty switching applications.

Braze alloys are essential in joining electrical components, ensuring structural stability and long-term durability. Silver Nickel materials are commonly used in low- and medium-voltage switchgear due to their balanced conductivity and resistance to welding. Silver Cadmium Oxide, despite environmental concerns, continues to be used in specific applications requiring high arc-quenching capability.

Material innovation and research into environmentally friendly alternatives are expected to shape future material trends within this market.

Type and Component Analysis

The market is segmented by type and component, covering electrical contacts, connectors, busbars, switches, relays, and circuit breaker components. Electrical contacts represent a significant share due to their critical role in ensuring uninterrupted power flow and minimizing electrical losses.

Busbars and connectors are increasingly adopted in renewable power plants and substations to enhance energy transmission efficiency. Meanwhile, industrial relays and switchgear systems rely heavily on silver-based alloys to ensure long operational life and minimal maintenance requirements.

As power loads increase globally, component manufacturers are focusing on enhancing durability, corrosion resistance, and conductivity performance to meet stringent industry standards.

Regional Market Outlook

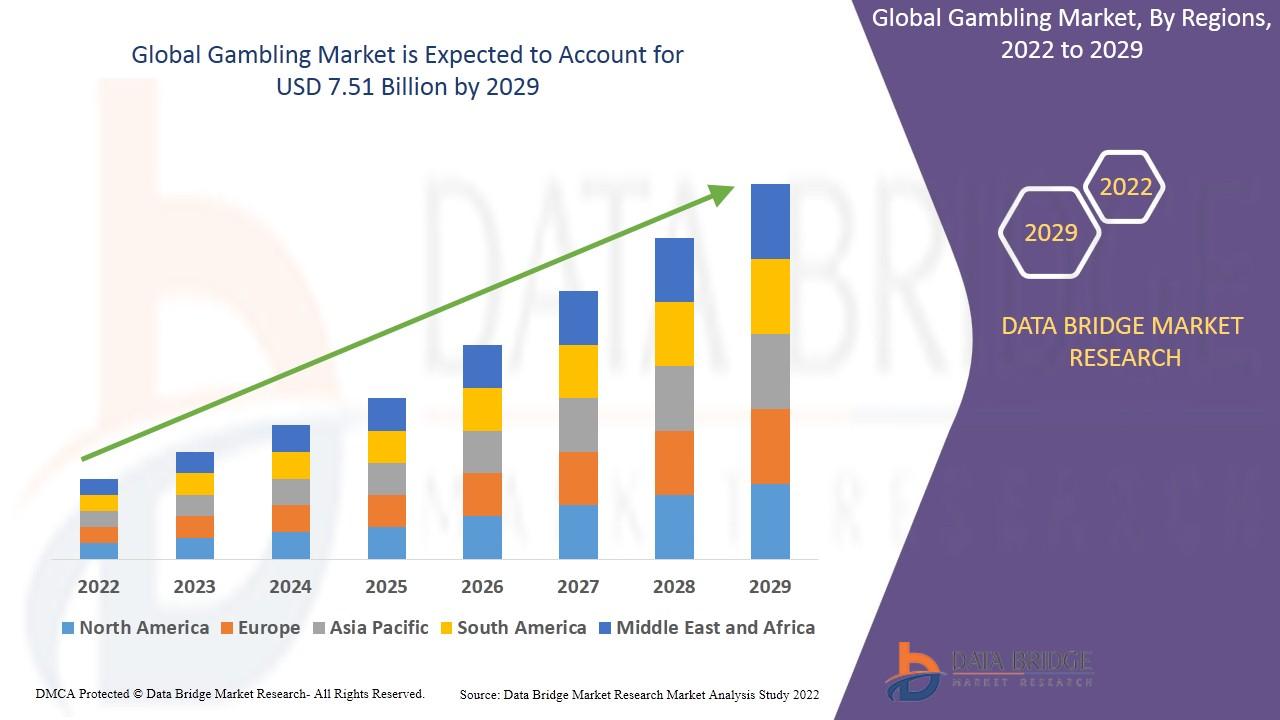

North America holds a substantial share of the market due to advanced grid infrastructure and significant investments in renewable energy integration. The region benefits from strong industrial automation and EV infrastructure expansion, driving consistent demand for copper and silver components.

Europe follows closely, supported by regulatory frameworks promoting energy efficiency and sustainable power solutions. Countries in the region are increasingly investing in smart grids and green energy projects, creating opportunities for high-performance conductive materials.

The Asia-Pacific region is expected to witness the fastest growth during the forecast period. Rapid industrialization, expanding manufacturing sectors, and infrastructure development in countries such as China and India are major contributors. Government initiatives aimed at strengthening power generation and distribution networks further accelerate regional market expansion.

Competitive Landscape and Key Players

The competitive landscape features both specialized material manufacturers and diversified industrial groups. Key players include Chugai Electric Industrial Co., Ltd., Concept Metal Group, Eckart (A company of ALTANA Group), ILF Ltd., and Johnson Matthey.

These companies focus on product innovation, material performance enhancement, and strategic collaborations to strengthen their market presence. Research and development activities aimed at improving conductivity, sustainability, and compliance with environmental standards are central to competitive strategies.

Strategic partnerships with power equipment manufacturers and industrial automation companies further enable market participants to expand their global footprint and diversify product offerings.

Emerging Opportunities and Technological Advancements

Technological advancements in power electronics and renewable energy storage systems are expected to create new opportunities for copper and silver component manufacturers. The rise of electric mobility, battery storage solutions, and advanced industrial robotics will continue to generate demand for highly conductive and durable materials.

Sustainability initiatives are also reshaping the market landscape. Manufacturers are exploring eco-friendly alternatives and recycling strategies to reduce environmental impact while maintaining performance standards. The development of advanced silver composites with reduced toxic content is likely to gain prominence over the forecast period.

Stakeholders seeking comprehensive insights, detailed segmentation analysis, and long-term growth projections can access a detailed sample report covering forecasts from 2025 to 2032.

Browse more Report: