Europe Digital Lending Platform Market Competitive Forecast and Growth Analysis 2029

"Executive Summary Europe Digital Lending Platform Market Market Size and Share: Global Industry Snapshot

CAGR Value

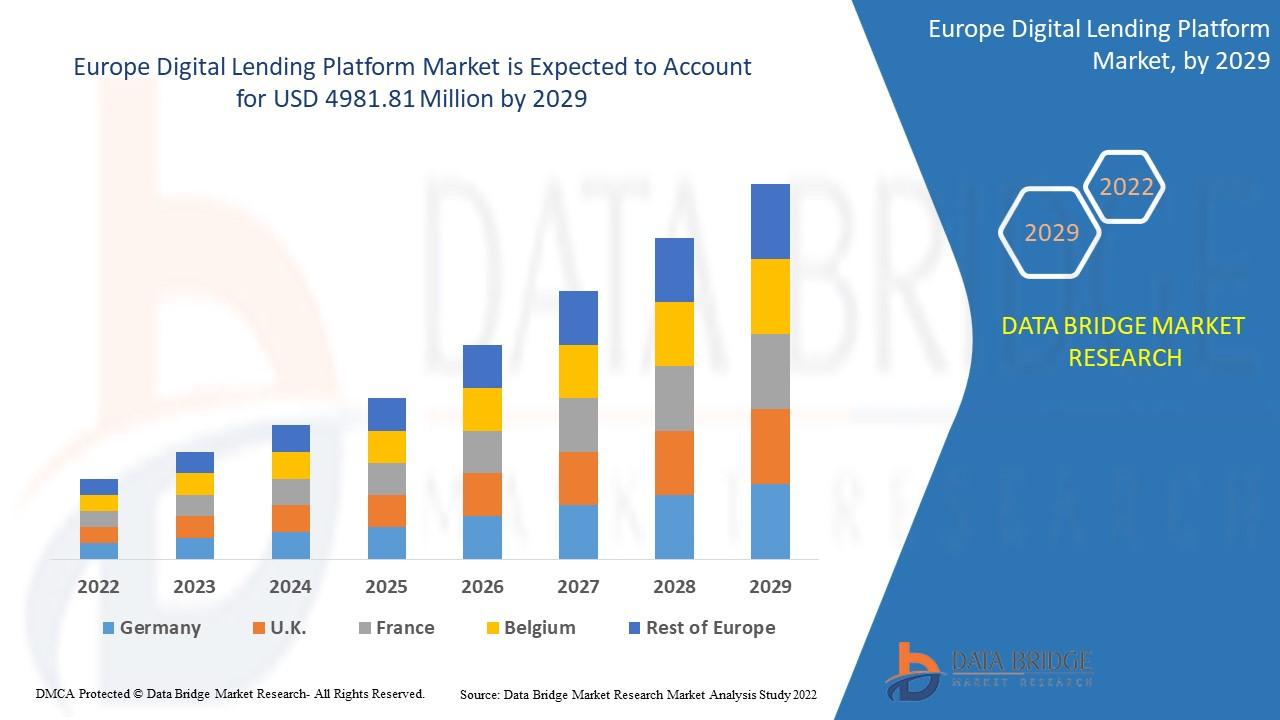

Europe digital lending platform market was valued at USD 1238.83 million in 2021 and is expected to reach USD 4981.81 million by 2029, registering a CAGR of 19.00% during the forecast period of 2022-2029.

Businesses can depend with confidence upon this superior Europe Digital Lending Platform Market Market report to bring about an utter success. An expert team involved in creating this report concentrates on understanding client’s businesses and its needs so that the deluxe market research report is delivered to the client. The company profiles of all the dominating market players and brands that are making moves such as product launches, joint ventures, mergers and acquisitions are described in the Europe Digital Lending Platform Market Market report. Talented capabilities and brilliant resources in research, data collection, development, consulting, evaluation, compliance and regulatory services work together to formulate this world-class Europe Digital Lending Platform Market Market research report.

Europe Digital Lending Platform Market Market research report predicts the size of the market with respect to the information on key merchant revenues, development of the industry by upstream and downstream, industry progress, key companies, along with market segments and application. For an actionable market insight and lucrative business strategies, a faultless market research report has to be there. It also becomes easy to analyse the actions of key players and respective effect on the sales, import, export, revenue and CAGR values. This data is useful for businesses in characterizing their individual strategies.

Stay informed with our latest Europe Digital Lending Platform Market Market research covering strategies, innovations, and forecasts. Download full report: https://www.databridgemarketresearch.com/reports/europe-digital-lending-platform-market

Europe Digital Lending Platform Market Market Trends & Analysis

Segments

- By Component: The Europe digital lending platform market can be segmented based on components into software and services. The software segment includes loan origination software, loan management software, risk and compliance management software, and others. The services segment comprises consulting, implementation, and support services.

- By Deployment: On the basis of deployment, the market can be categorized into cloud-based and on-premises digital lending platforms. Cloud-based platforms offer scalability, flexibility, and cost-effectiveness, making them increasingly popular among businesses.

- By End-User: In terms of end-users, the market can be divided into banks, credit unions, fintech companies, peer-to-peer lending platforms, and others. Banks and financial institutions are adopting digital lending platforms to streamline their lending processes, enhance customer experience, and reduce operational costs.

- By Region: Geographically, the Europe digital lending platform market can be segmented into countries such as the United Kingdom, Germany, France, Italy, Spain, and the rest of Europe. Each region may have varying adoption rates based on factors like regulatory environment, technological infrastructure, and market maturity.

Market Players

- Blend Labs: Blend Labs offers a digital lending platform that enables lenders to streamline the borrowing process, assess credit risk more accurately, and provide a seamless customer experience.

- Mambu: Mambu provides a cloud-native digital banking platform that empowers financial institutions to offer personalized lending products, automate processes, and drive digital transformation.

- Temenos: Temenos offers a comprehensive digital lending solution that helps banks and financial institutions to digitize their lending operations, accelerate loan processing, and optimize risk management.

- nCino: nCino's digital lending platform enhances loan origination, underwriting, and servicing processes, enabling financial institutions to increase efficiency, reduce costs, and improve customer satisfaction.

- FIS Global: FIS Global delivers a digital lending platform that integrates with core banking systems, enabling lenders to streamline loan management, automate decision-making, and enhance regulatory compliance.

The Europe digital lending platform market is witnessing significant growth due to the increasing adoption of digital technologies in the banking and financial sector. With the rise of online lending platforms, there is a growing demand for efficient, user-friendly solutions that can automate lending processes, mitigate risks, and enhance customer experience. Market players are focusing on innovation, partnerships, and strategic acquisitions to expand their product offerings and gain a competitive edge in the market.

The Europe digital lending platform market is currently experiencing a transformative phase driven by advancements in digital technologies and the increasing shift towards online lending solutions. One of the key trends shaping the market is the growing emphasis on personalized lending products and services to cater to the diverse needs of customers. This trend is being fueled by the rising customer expectations for a seamless and efficient borrowing experience. Market players are increasingly focusing on developing innovative solutions that leverage data analytics, artificial intelligence, and automation to customize loan offerings, streamline processes, and improve decision-making.

Moreover, regulatory initiatives aimed at promoting transparency, security, and consumer protection in the lending sector are influencing the market dynamics. Compliance with regulations such as GDPR and PSD2 is becoming a top priority for digital lending platform providers, driving them to enhance data security measures, ensure data privacy, and maintain regulatory compliance. This compliance-driven approach is shaping the development of digital lending platforms to incorporate robust risk management features, identity verification processes, and audit trails to meet regulatory requirements and build trust among customers.

Another significant factor influencing the Europe digital lending platform market is the increasing competition among financial institutions, fintech companies, and alternative lenders. The growing competition is driving organizations to differentiate their offerings by leveraging technology to deliver faster loan approvals, personalized services, and seamless digital experiences. Fintech disruptors are challenging traditional lenders by offering innovative lending solutions that are quick, convenient, and tailored to individual borrower profiles.

Furthermore, the market is witnessing a shift towards collaborative partnerships and ecosystem integration to enhance the capabilities of digital lending platforms. Market players are increasingly forming strategic alliances with technology providers, data analytics firms, and regulatory experts to strengthen their product offerings, expand their market reach, and deliver end-to-end solutions that address the evolving needs of the lending industry. These partnerships enable digital lending platform providers to access new technologies, expertise, and resources that enhance their competitive position and drive innovation in the market.

Overall, the Europe digital lending platform market is poised for continued growth and evolution as market players focus on advancing technological capabilities, enhancing customer experiences, and navigating regulatory complexities. The convergence of digital innovation, regulatory compliance, and competitive dynamics is reshaping the lending landscape and driving the adoption of digital lending platforms as essential tools for modernizing lending operations, improving efficiency, and delivering value to both lenders and borrowers.The Europe digital lending platform market is undergoing a substantial transformation fueled by the rapid digitalization of the banking and financial sector. One of the key drivers of this transformation is the increasing demand for personalized lending products and services to cater to the diverse needs of customers. This trend is pushing market players to innovate and develop solutions that leverage data analytics, artificial intelligence, and automation to customize loan offerings, streamline processes, and enhance decision-making. The emphasis on providing a seamless and efficient borrowing experience is reshaping the market landscape, with lenders looking to differentiate themselves by offering faster loan approvals, personalized services, and a digital-first approach.

Moreover, regulatory initiatives aimed at ensuring transparency, security, and consumer protection in the lending sector are shaping the dynamics of the market. Compliance with regulations such as GDPR and PSD2 is becoming a top priority for digital lending platform providers, leading to investments in data security measures, privacy enhancements, and regulatory compliance frameworks. This compliance-focused approach is driving the development of digital lending platforms with robust risk management features, identity verification processes, and audit trails to meet regulatory requirements and build trust among customers.

Additionally, the intensifying competition among financial institutions, fintech companies, and alternative lenders is driving organizations to leverage technology to deliver innovative lending solutions. Fintech disruptors are challenging traditional lenders by offering quick, convenient, and personalized lending services tailored to individual borrower profiles. This competitive landscape is prompting market players to enhance their offerings through technological advancements, partnerships, and ecosystem integration to deliver seamless digital experiences and gain a competitive edge.

Furthermore, collaborative partnerships and ecosystem integration are emerging trends in the Europe digital lending platform market. Market players are forming strategic alliances with technology providers, data analytics firms, and regulatory experts to strengthen their product offerings, expand their market reach, and provide end-to-end solutions that address the evolving needs of the lending industry. These partnerships enable digital lending platform providers to access new technologies, expertise, and resources that enhance their competitive position and promote innovation in the market.

In conclusion, the Europe digital lending platform market is poised for continued growth and innovation as market players navigate regulatory complexities, enhance technological capabilities, and focus on delivering exceptional customer experiences. The convergence of digital innovation, regulatory compliance, and intense competition is reshaping the lending landscape and positioning digital lending platforms as essential tools for modernizing lending operations, improving efficiency, and delivering value to both lenders and borrowers.

Learn about the company’s position within the industry

https://www.databridgemarketresearch.com/reports/europe-digital-lending-platform-market/companies

Europe Digital Lending Platform Market Market Overview: Strategic Questions for Analysis

- How large is the Europe Digital Lending Platform Market Market in terms of market cap?

- How rapidly is the Europe Digital Lending Platform Market Market expanding globally?

- What are the major verticals identified in the segmentation analysis for Europe Digital Lending Platform Market Market?

- Who are the industry leaders mentioned in the Europe Digital Lending Platform Market Market report?

- Which countries show strong Europe Digital Lending Platform Market Market activity?

- What corporations have major influence on Europe Digital Lending Platform Market Market trends?

Browse More Reports:

Global Dumbbells Market

Global Dump Trucks Market

Global Dunbar Syndrome Treatment Market

Global Egg Yolk Powder Market

Global Elbow Replacement Orthopedic Devices Market

Global Electrical Computer Aided Design Market

Global Electricity and Steam Generation Waste Heat Recovery Systems Market

Global Electric Vehicle Heat Shrink Tubing Market

Global Electric Vehicle Sensor Market

Global Electron Microscope Market

Global Electrophysiology Mapping and Ablation Devices Market

Global Emulsifiers in Dietary Supplements Market

Global Encephalitis Treatment Market

Global Endocrine Disorders Market

Global Endoscopic Retrograde Cholangiopancreatography Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"