Digital Lending Platform Market Size, Current Status, and Outlook 2030

Introduction

The Digital Lending Platform Market refers to software and services that enable financial institutions, fintech firms, and non-bank lenders to originate, underwrite, service, and manage loans digitally. These platforms automate key processes such as loan application, decisioning, disbursement, collections, and compliance-monitoring, usually delivered through online or mobile channels.

Learn how the Digital Lending Platform Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market

The Evolution

Digital lending platforms trace their origins to the proliferation of online banking in the early 2000s. Initial platforms supported basic loan origination online, but significant manual intervention remained.

From around 2010 onward, the convergence of mobile devices, cloud computing, big data analytics, and open-banking APIs catalyzed a shift. Fintech entrants emerged offering end-to-end digital borrowing experiences. Key milestones included the introduction of loan-origination automation, e-KYC (electronic know-your-customer) procedures, and risk-scoring models based on alternative data.

Around 2015–2020, advanced capabilities such as artificial intelligence (AI) for credit decisioning, machine-learningpowered fraud detection, and digital servicing workflows became mainstream. More recently, innovations like embedded-lending models, buy-now-pay-later (BNPL) schemes, and open-architecture APIs for ecosystem integration mark the current phase of evolution. These shifts reflect lenders’ drive to deliver faster, more convenient and scalable lending services in an increasingly digital economy.

Market Trends

Several major trends dominate the Digital Lending Platform Market today:

1. Embedded Lending and BNPL Growth

Embedded finance—where lending is integrated into non-financial platforms such as e-commerce, mobility, or point-of-sale systems—is gaining popularity. BNPL is a related model that leverages digital lending platforms to offer short-term credit at purchase points, growing rapidly among millennials and Gen Z.

2. AI, Machine Learning and Alternative Data

Lenders increasingly adopt AI and ML models to analyse vast datasets—social, behavioural, transaction, and device data—to assess credit risk and detect fraud. These analytics improve decisioning speed and accuracy, reducing default risk and operational costs.

3. Cloud Deployment and SaaS Models

Cloud-native lending platforms are replacing traditional on-premise solutions. The cloud delivers scalability, faster implementation, lower upfront costs, and flexibility in underwriting and servicing—especially for fintechs and smaller lenders.

4. Open Banking and API Ecosystems

Open banking frameworks and APIs allow lenders to access real-time data from banks, fintechs and alternative providers. This connectivity enhances borrower profiling, reduces onboarding friction, and supports automated decisioning workflows.

5. Financial Inclusion and Emerging Markets

Digital lending platforms are instrumental in expanding access to credit in underserved regions—particularly in Asia-Pacific, Africa and Latin America. Mobile penetration, fewer branch infrastructures and younger populations propel uptake of digital credit solutions.

6. Regulatory Focus and Consumer Protection

Regulators in many regions are formalising frameworks governing digital lending platforms, emphasising transparency, data protection, fair pricing and responsible-lending practices. Compliance-tools embedded within platforms grow in importance.

Challenges

Growth in the digital lending platform market faces several high-priority challenges:

1. Credit Risk and Underwriting Accuracy

While alternative-data models offer broader access, lenders must manage higher default risk inherent in digital credit. Ensuring robust underwriting and responsible lending is critical.

2. Data Privacy, Cybersecurity and Fraud

Digital platforms collect sensitive personal and financial information. Ensuring data privacy, preventing cyber-attacks and managing fraud remain key barriers to adoption.

3. Regulatory Complexity and Variation

Regulation varies significantly across jurisdictions, covering debt-collection practices, interest-rate caps, licensing and data-sharing standards. Navigating this complexity adds cost and delays market entry.

4. Legacy Systems and Integration Issues

Banks often operate legacy IT systems. Migrating or integrating digital-lending platforms with core banking, risk systems and regulatory-reporting software is time-consuming and costly.

5. Consumer Trust and Adoption

In many markets, digital lending is still nascent. Building borrower trust, ensuring transparent terms and educating consumers on digital credit remain hurdles in less-mature regions.

Market Scope

The Digital Lending Platform Market can be segmented comprehensively across component, lending model, end use and region.

By Component:

-

Solutions (Loan Origination, Underwriting/Risk Assessment, Servicing/Collections, Compliance & Regulatory)

-

Services (Consulting, Implementation, Support & Maintenance)

By Deployment Model:

-

On-Premise

-

Cloud / Software-as-a-Service (SaaS)

By Lending Model:

-

Retail Consumer Lending

-

Small & Medium Enterprise (SME) Lending

-

Buy-Now-Pay-Later (BNPL)

-

Embedded Lending via Platforms

By End-User:

-

Banks

-

Non-Bank Financial Institutions (NBFCs)

-

Fintech Lending Platforms

-

Credit Unions & Cooperatives

Regional Analysis:

-

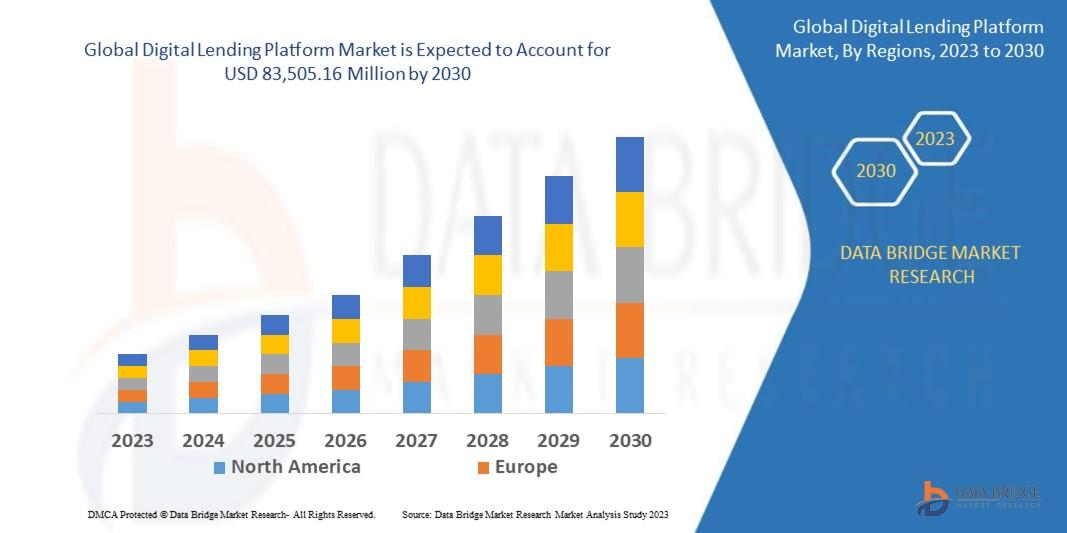

North America: The largest market in 2024, supported by mature fintech infrastructure and strong regulatory support.

-

Europe: Significant adoption driven by open banking frameworks, digital banking incumbents and fintech innovation.

-

Asia-Pacific: The fastest-growing region, led by China, India, Southeast Asia with mobile-first populations and underserved credit segments.

-

Latin America: Emerging market with rising mobile usage, digital financial services uptake and regulatory reforms.

-

Middle East & Africa: Early-stage growth; digital lending platforms are gaining traction as financial inclusion and regulatory frameworks evolve.

Market Size and Factors Driving Growth

Data Bridge Market Research analyses that the global digital lending platform market which was USD 20,215.23 million in 2022, is expected to reach USD 83,505.16 million by 2030, and is expected to undergo a CAGR of 19.4% during the forecast period of 2023 to 2030.

Key growth drivers:

-

Digital transformation of financial services. Banks and lenders are accelerating digital lending adoption to cut costs, improve customer experience and compete with fintech entrants.

-

Rising smartphone and internet penetration. More consumers can access credit via mobile platforms rather than branch-based channels.

-

Growth of embedded finance and BNPL. Integration of lending within retail and platform ecosystems opens new segments and borrower demographics.

-

Under-banked and financially excluded populations. Digital lending platforms can reach consumers and SMEs unserved by traditional banking, especially in emerging economies.

-

Regulatory support and open banking. Data-sharing frameworks and fintech-friendly regulation support rapid deployments of digital-lending solutions.

-

Advancements in AI/ML, cloud infrastructure and analytics. These technologies drive efficiency, risk-management and scale, making digital lending platforms more viable.

Conclusion

The Digital Lending Platform Market stands at a pivotal juncture. With accelerating digitalization, rising consumer expectations for seamless borrowing experiences and increasing regulatory support for digital finance, the market is primed for long-term growth.

Ahead, success will depend on combining robust technology, strong risk-management frameworks and alignment with regulatory and consumer-protection imperatives. Players that innovate in AI-driven underwriting, embed lending into broader ecosystems and expand into emerging markets will be best positioned.

By 2035, digital lending platforms are expected to be core infrastructure for modern lending—supporting retail, SME, BNPL and embedded finance models globally. The market will continue to mature with improved regulatory clarity, deeper technology stacks and broader access to credit across regions.

Frequently Asked Questions (FAQ)

1. What is a digital lending platform?

A digital lending platform is a software and services infrastructure that enables online or mobile loan origination, decisioning, servicing and collections—replacing or reducing traditional manual processes.

2. How large is the digital lending platform market today?

The global market is estimated at around USD 10.5 billion in 2024.

3. What is the projected market value by 2035?

One forecast estimates the market will reach approximately USD 72.6 billion by 2035, with a CAGR of about 17.2% from 2025 to 2035.

4. Which regions are leading the market?

North America currently leads in market size. The Asia-Pacific region is projected to grow fastest, with strong mobile adoption, large under-banked populations and digital-first initiatives.

5. What are the major growth drivers?

Key drivers include mobile/internet proliferation, digital banking transformation, AI/analytics adoption, embedded finance/BNPL models, and regulatory frameworks promoting digital credit.

6. What are the main challenges?

Challenges include managing credit risk in digital loans, data privacy and cybersecurity, regulatory complexity, integration with legacy systems, and building consumer trust in digital credit.

7. Which segments are witnessing fastest innovation?

Embedded lending models and BNPL offerings are among the fastest-growing segments. Additionally, AI-powered underwriting and risk assessment modules are seeing rapid innovation.

8. How are cloud deployments shaping the market?

Cloud-native lending platforms offer faster implementation, scalability and cost efficiency compared to on-premise systems, making them increasingly preferred by fintechs and smaller lenders.

9. What should new market entrants focus on?

New entrants should focus on robust credit risk analytics, regulatory-compliance capabilities, mobile and API-driven user experiences and expansion into underserved regions.

10. What is the long-term outlook for the market?

The long-term outlook is positive. As digital lending becomes mainstream, platforms will evolve into fully integrated lending ecosystems supporting multiple product types and channels globally.

Browse More Reports:

Global Energy Intelligence Solution Market

Global Engineering Plastics Solid Masterbatch Market

Global Enhanced Vision System Market

Global Epiglottic Abscess Market

Global Episodic Ataxia Treatment Market

Global Esters Market

Global Ewing Sarcoma Drug Market

Global Exhaust Sensors for Automotive Market

Global External Cloud Automotive Cyber Security Services Market

Global Extreme Ultraviolet Lithography Market

Global Facial Cleansers and Toners Market

Global Facial Fat Transfer Market

Global Fairtrade Food and Beverages Market

Global Fatty Acid Esters Market

Global Fatty Liver Diseases Treatment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com