Europe Olive Oil Market Size, Current Status, and Outlook 2029

Introduction

The Europe Olive Oil Market encompasses the production, importation, distribution and consumption of olive oil—including extra virgin, virgin and refined grades—across European countries, notably those in the EU and adjacent markets. Olive oil plays a vital role not only in Mediterranean cuisine but also in health-oriented diets, and thus holds significant import in regional food supply chains and international trade.

Globally, olive oil is prized for its monounsaturated fats, antioxidants and association with cardiovascular health. Europe accounts for a large share of production and consumption.

Learn how the Europe Olive Oil Market is evolving—insights, trends, and opportunities await. Download report: https://www.databridgemarketresearch.com/reports/europe-olive-oil-market

The Evolution

The European olive oil market has a longstanding heritage, with production centres in Spain, Italy, Greece and Portugal dating back centuries. In the post-World War II era, industrialisation of olive cultivation and oil processing accelerated in Southern Europe. Spain emerged as the world’s largest producer, with Italy and Greece following.

During the 1990s and early 2000s, the Mediterranean diet gained global recognition, increasing domestic and export demand for high-quality extra virgin olive oil. Quality labelling regimes and geographic indications (PDO/PGI) strengthened consumer trust and premium pricing.

In the 2010s, sustainability concerns, traceability requirements, and packaging innovation (e.g., dark glass, tin containers) gained traction. Digital platforms enabled direct-to-consumer sales of boutique olive oils.

In the early 2020s, climate-driven yield fluctuations and supply-chain stresses—especially droughts in Spain and Greece—led to higher prices and conditional shifts in consumption. These developments forced producers to adopt intensive cultivation methods, mechanisation and improved harvesting and processing technologies.

Market Trends

1. Premiumisation and quality differentiation. European consumers increasingly favour extra virgin and single-estate oils. Organic and sustainably certified olive oils are gaining share in retail. For example, the extra virgin segment led the European market in 2024.

2. Sustainability and traceability. Consumers demand provenance and authenticity. Brands adopt blockchain, QR-code labelling and certifications to build trust.

3. Packaging and design innovation. Dark glass bottles, tin cans and portion-controlled formats appeal to premium buyers and foodservice channels.

4. Export-oriented growth. While domestic consumption has matured, European producers are increasingly targeting exports. The EU is approximately 65 % of world olive-oil exports.

5. Health and functional positioning. Marketing emphasises olive oil’s nutritional benefits. The “liquid gold” narrative persists in Europe and beyond.

6. Online and direct-to-consumer sales. E-commerce and subscription models enable producers to reach consumers across Europe and globally.

7. Cultivation technology shifts. Intensive plantations, advanced irrigation, mechanised harvesting and improved milling technologies are being adopted to improve yield and quality. Some EU reports suggest a pivot toward more efficient systems.

Challenges

Supply-chain volatility. Production is highly concentrated; Spain, Italy and Greece dominate. Climate change, drought, pest outbreaks and inflationary pressure raise production risk.

Price sensitivity and substitution. Olive oil is more expensive than many seed oils. Inflationary pressures have led to consumption declines in some countries. For instance, one-third of Italians reported reduced extra virgin olive oil use in 2024 due to price increases.

Authenticity and fraud. Adulteration and mislabelling remain issues. Cases of non-extra virgin oils sold as premium are increasing in the EU.

Mature consumption in core markets. Traditional Mediterranean countries have high per-capita consumption (e.g., Greece 9.3 kg, Spain 7.5 kg, Italy 7.4 kg). This reduces growth potential in those markets.

Regulatory and trade pressure. Tariffs, import quotas and changing trade rules add complexity. Export-oriented producers must navigate multiple markets.

Competition for resources. Land use pressures, water scarcity and rising costs of input make new expansion challenging.

Market Scope

By Type:

-

Extra Virgin Olive Oil (EVOO)

-

Virgin Olive Oil

-

Refined/Pure Olive Oil

-

Olive-Pomace Oils

By Packaging/Format:

-

Bottles (glass, PET)

-

Cans/Tins

-

Pouches & bulk for food-service

By Application/End-Use:

-

Household/Retail

-

Foodservice (restaurants, catering)

-

Food manufacturing (ingredients, ready-to-eat)

-

Non-food use (cosmetics, premium gift oil)

Regional Analysis:

-

Southern Europe: Spain, Italy, Greece, Portugal – largest production and consumption.

-

Western Europe: France, Germany, UK – growing premium demand, lower per-capita consumption.

-

Eastern Europe & Non-EU: Poland, Czechia, Hungary – emerging markets with lower baseline consumption, potential for growth.

End-User Industries:

-

Supermarkets/hypermarkets, specialty gourmet stores, online retail

-

Foodservice segments focusing on Mediterranean, healthy cuisine

-

Gourmet/trade channels exporting European olive oil globally

-

Private-label manufacturers using olive oil in packaged foods

Market Size and Factors Driving Growth

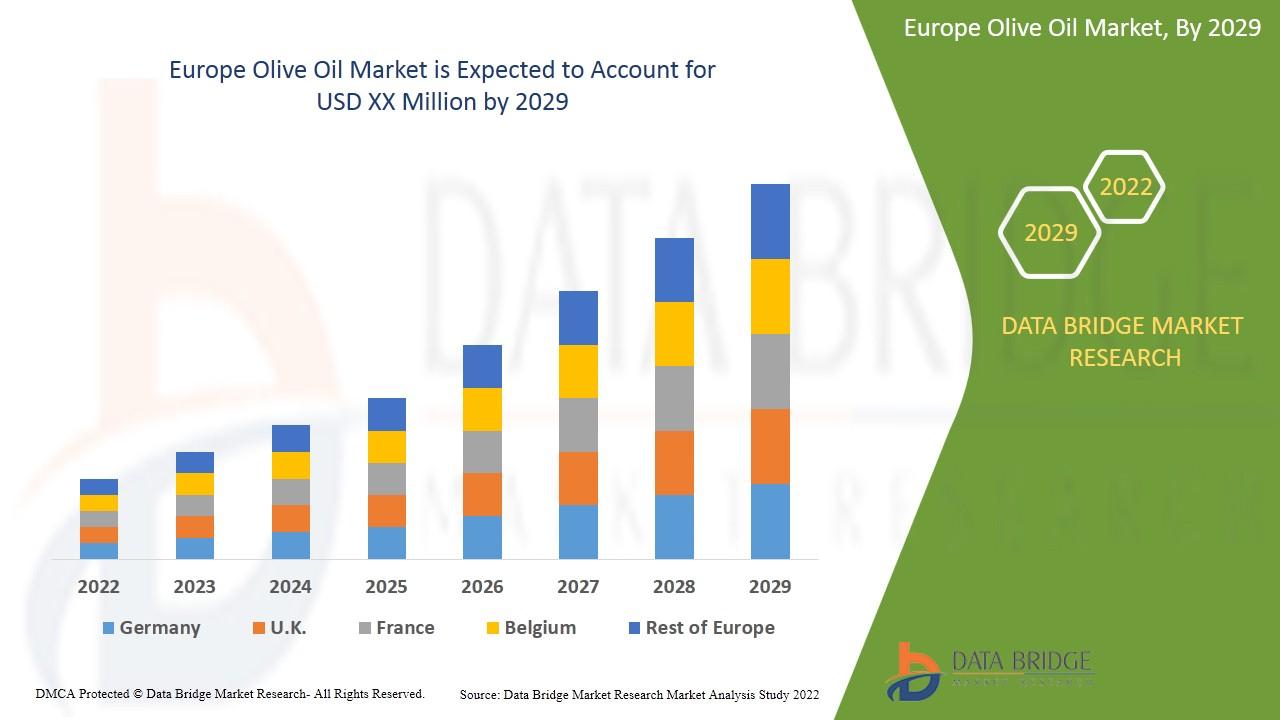

Increasing use of olive oil coupled with the growing application of olive oil in personal/skincare products has surged its demand. Data Bridge Market Research analyses that the Europe olive oil market will grow at a CAGR of 5.1% during the forecast period of 2022 to 2029.

-

Health awareness and dietary trends. The adoption of Mediterranean diet-patterns, increased interest in functional foods and better fats supports olive oil usage.

-

Premiumisation. Consumers are shifting from standard olive oils to extra virgin, organic and single estate oils, increasing value per volume.

-

Export opportunities. European producers benefit from global demand, including in North America and Asia, particularly as European oils are seen as premium. The EU exported 252,000 tonnes to the U.S. in a crop year, valued at over €1.2 billion.

-

Processing and cultivation innovation. Mechanised harvesting, intensive cultivation and new varietals help improve yield and reduce cost per litre.

-

Packaging, branding and gourmet channels. Boutique oils, gift packaging, and direct-consumer channels support higher margins and brand differentiation.

-

Sustainability and traceability demands. Producers that adopt eco-friendly practices or geographic indications can capture the value premium.

-

E-commerce growth. Online platforms allow consumers to access a broader range of oils across Europe and globally, enhancing reach beyond traditional retail.

Conclusion

Nevertheless, the market faces challenges in supply-chain resilience, inflation-driven consumption adjustments, and widening competition from alternative oils. Traditional Mediterranean producing countries will experience slow volume growth or even declining consumption, while non-traditional and export markets offer incremental opportunity.

For stakeholders—producers, brand owners, distributors, and exporters—the focus will shift to value rather than volume: quality differentiation, brand storytelling, traceability, premium packaging, and global market penetration will define success. Sustainability, provenance and digital commerce will be central to future growth strategies.

FAQs

Q1. What is included in the Europe olive oil market?

The market includes production, imports, processing, distribution and consumption of olive oil (all grades) in European countries, covering household retail, foodservice and industrial use.

Q2. What is the current market size?

The market is estimated at about USD 12.6 billion in 2025 according to a key report.

Q3. What is the expected growth rate?

The market is expected to grow at a compound annual growth rate (CAGR) of around 3.6% to 4.0% between 2025 and 2032.

Q4. Which countries are leading production and consumption in Europe?

Spain, Italy, Greece and Portugal dominate production and consumption. Spain produces around 63% of European olive oil output.

Q5. What are the major drivers of market growth?

Major drivers include health and wellness trends, premiumisation of olive oil products, export-oriented production, packaging innovation, e-commerce expansion and traceability demands.

Q6. What are the main challenges?

Key challenges include supply-chain volatility (climate, pests), price sensitivity, fraud and authenticity, mature demand in core markets, and regulatory/trade complexity.

Q7. What segments are growing fastest?

Extra virgin and organic olive oils are growing fastest, with value growth stronger than volume growth. Boutique, single estate and infused oils are emerging opportunities.

Q8. What is the export outlook?

Europe is a major exporter of olive oil. The EU exports 65% of global olive oil exports and supplies key markets such as the U.S. and Brazil.

Q9. How is consumer behaviour shifting?

Consumers increasingly demand high-quality oils with health claims, sustainability credentials and premium packaging. Online and direct-to-consumer purchasing is rising. Infused oils and gourmet formats are gaining traction.

Q10. What is the strategy for stakeholders?

Stakeholders should focus on quality, brand differentiation, traceability, export penetration, packaging innovation and digital channels. Emphasising sustainability credentials and leveraging premium positioning will be vital for success in a mature market.

Browse More Reports:

Global Body Control Module Market

Global Biaxially Oriented Polypropylene (BOPP) Films for Packaging Market

Global Botanical Drug-Based Oncology Market

Global Branched Stent Grafts Market

Global Breast Lesion Guidance Systems Market

Global Broadcast Equipment Market

Global Brushless DC Motor Market

Global Buildtech Textiles Market

Global Bulk Bag Divider Market

Global Bundling Films Market

Global Business Jet Market

Global BYOD and Enterprise Mobility Market

Global Cable Television (CATV) Broadcasting Equipment Market

Global Calcitonin Gene-Related Peptide Receptor Antagonist Market

Global Cancer Tumor Profiling Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com